Professional Tips on Getting Approved for a Secured Credit Card Singapore

Professional Tips on Getting Approved for a Secured Credit Card Singapore

Blog Article

Exploring Options: Can Former Bankrupts Secure Debt Cards Complying With Discharge?

One typical inquiry that emerges is whether previous bankrupts can efficiently get credit rating cards after their discharge. The answer to this query includes a diverse exploration of various factors, from credit scores card options tailored to this group to the impact of previous economic decisions on future creditworthiness.

Understanding Bank Card Options

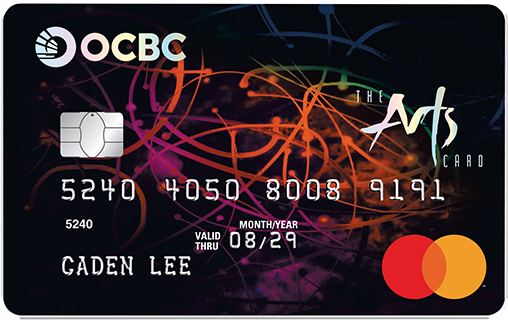

Navigating the realm of credit report card choices needs a keen understanding of the differing functions and terms available to customers. When taking into consideration bank card post-bankruptcy, people need to very carefully evaluate their needs and economic circumstance to choose the most ideal choice - secured credit card singapore. Secured credit rating cards, as an example, need a cash down payment as security, making them a feasible choice for those aiming to reconstruct their credit rating. On the various other hand, unprotected bank card do not necessitate a deposit yet may feature higher rates of interest and costs.

In addition, people must pay close attention to the yearly portion rate (APR), grace duration, yearly charges, and benefits programs offered by various credit rating cards. By comprehensively evaluating these variables, people can make educated choices when selecting a credit report card that lines up with their financial objectives and scenarios.

Elements Impacting Authorization

When applying for credit report cards post-bankruptcy, recognizing the variables that influence authorization is vital for individuals seeking to rebuild their financial standing. Following a bankruptcy, credit rating scores frequently take a hit, making it harder to certify for traditional credit rating cards. Demonstrating liable economic habits post-bankruptcy, such as paying expenses on time and keeping credit report use low, can also favorably affect credit report card approval.

Safe Vs. Unsecured Cards

Recognizing the distinctions in between unsafe and guaranteed charge card is critical for people post-bankruptcy looking for to make educated decisions on rebuilding their financial health. Secured bank card require a cash down payment as security, normally equal to the credit line extended by the provider. This down payment minimizes the threat for the credit card firm, making it a feasible choice for those with a history of personal bankruptcy or inadequate credit report. Safe cards commonly include lower credit line and higher rate of interest contrasted to unsafe cards. On the other hand, unsecured charge card do not call for a cash down payment and are based entirely on the cardholder's creditworthiness. These cards commonly use higher credit scores restrictions and lower rate of interest for people with good credit rating. However, post-bankruptcy individuals may discover it challenging to get unprotected cards promptly after discharge, making protected cards an extra possible alternative to start reconstructing credit history. Inevitably, the choice in between safeguarded and unsecured credit score cards relies on the individual's economic situation and credit scores goals.

Building Credit Properly

To properly rebuild credit scores post-bankruptcy, developing a pattern of liable credit rating usage is necessary. One essential method to do this is by making prompt payments on all charge account. Payment history is a substantial consider figuring out credit report, so ensuring that all bills are paid in a timely manner can gradually improve creditworthiness. Additionally, maintaining credit history card balances low family member to the credit report restriction can favorably affect credit report. secured credit card singapore. Professionals suggest keeping credit report use below 30% to demonstrate liable credit monitoring.

Another method for constructing credit scores properly is to keep an eye on debt reports routinely. By evaluating credit score records for mistakes or indicators important link of identification theft, individuals can address issues promptly and maintain the precision of their credit rating history.

Reaping Long-Term Benefits

Having established a structure of accountable credit report administration post-bankruptcy, individuals can currently concentrate on leveraging their improved creditworthiness for long-term economic advantages. By regularly making on-time payments, maintaining credit report usage reduced, and monitoring their credit scores records for accuracy, previous bankrupts can slowly restore their credit report. As their credit history raise, they may come to be eligible for far better charge card provides with lower rates of interest and greater credit history limits.

Gaining long-term benefits from improved creditworthiness prolongs past simply debt cards. Additionally, a positive debt profile can enhance work leads, as some companies might examine credit rating reports as their website part of the hiring procedure.

Verdict

Finally, former bankrupt people might have problem safeguarding bank card adhering to discharge, yet there are choices available to aid restore credit history. Comprehending the various kinds of charge card, aspects impacting approval, and the value of accountable bank card use can aid people in this circumstance. By choosing the best card and using it properly, former bankrupts can gradually improve their credit rating and enjoy the long-term benefits of having accessibility to credit scores.

Demonstrating responsible economic browse around these guys actions post-bankruptcy, such as paying expenses on time and keeping credit history usage low, can additionally favorably influence credit history card approval. In addition, maintaining credit scores card equilibriums reduced family member to the credit scores limit can favorably affect credit history ratings. By continually making on-time repayments, keeping debt use reduced, and checking their debt records for precision, former bankrupts can gradually restore their credit ratings. As their credit report scores boost, they may become qualified for much better credit card offers with lower passion rates and greater credit score limits.

Recognizing the different types of debt cards, variables impacting authorization, and the importance of accountable credit card usage can aid people in this situation. secured credit card singapore.

Report this page